Ashgrove, Queensland: Old Brisbane Soul, New-Life Convenience

- Cyan Dai

- Aug 20, 2025

- 7 min read

If Brisbane has “blue-chip” postcodes that quietly hold their value through every cycle, Ashgrove sits near the top of the list. Five kilometres north-west of the CBD, this leafy, undulating suburb blends inter-war architecture with upgraded sports grounds, excellent schools and swift bus/bike links to the city—making it one of the inner north’s most bankable addresses.

An old-money suburb that still moves

Ashgrove’s reputation was built on its “Ashgrovian” Queenslanders—multi-gabled, inter-war timber homes that gave the area its distinctive streetscape. Those pre-war character protections endure today, helping preserve the look and feel that buyers pay a premium for.

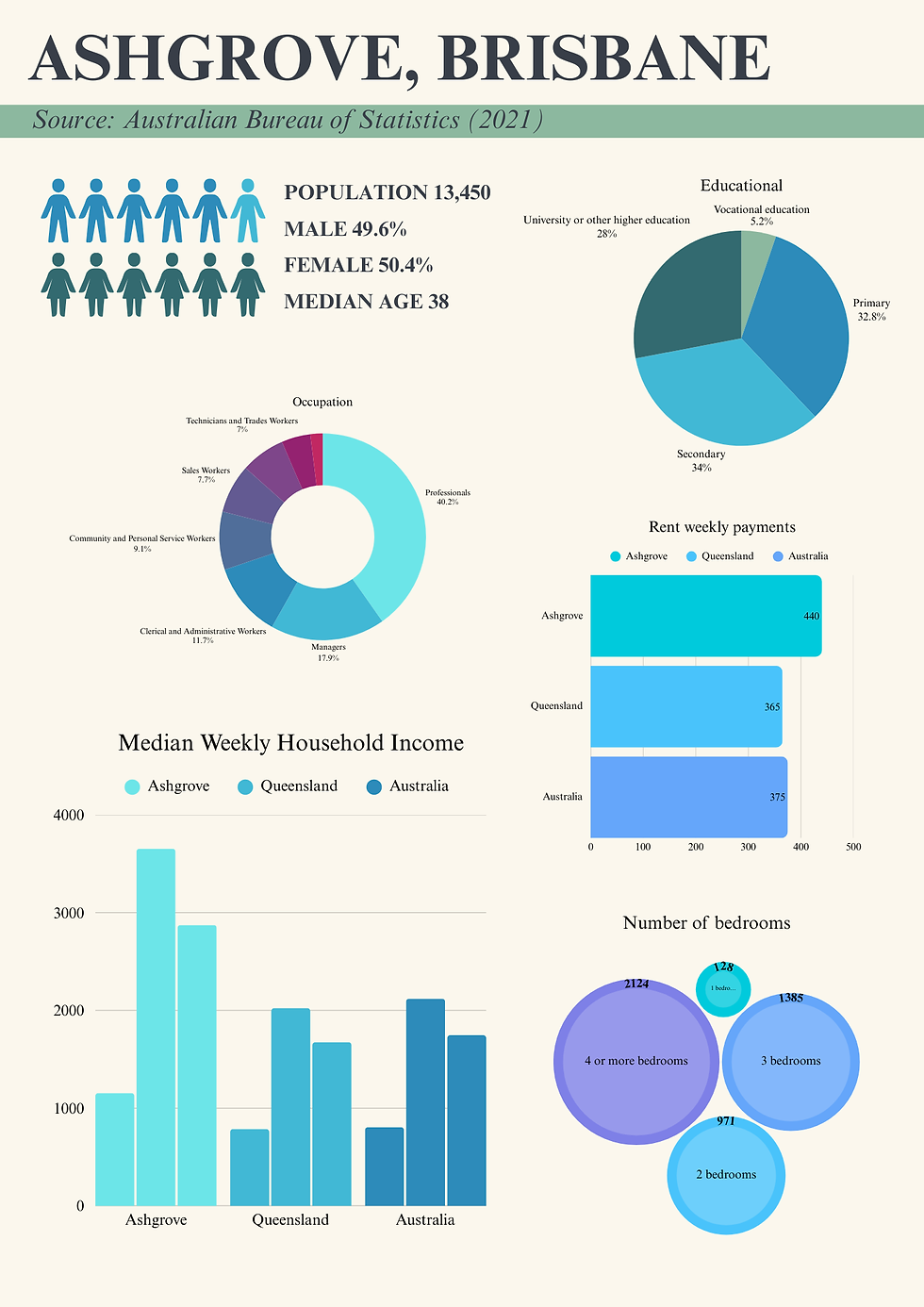

Ashgrove’s numbers tell a clear story: a suburb of 13,716 residents with a median age of 38, earning a $2,873 median weekly household income and boasting 49.2% bachelor-degree attainment. With 71.5% of homes owner-occupied, the area’s character streets and school belt translate into long-term stability. The market agrees—Aug 2025 readings place the median house price at $1.84m–$1.89m, up roughly 10% year on year, underscoring deep demand for blue-chip, near-CBD family living.

Why it sells: A stable owner-occupier base and professional cohort translate to resilient prices, faster decisions, and strong long-term value retention—especially for well-designed, character-sensitive homes.

Location & access

Two key arterials—Waterworks Road and Enoggera Road—connect Ashgrove directly to the CBD. Public transport is frequent and simple: the Maroon CityGlider (Route 61) provides high-frequency service long hours across the week, and the 385 BUZ is a mainstay link between The Gap, Ashgrove and the city. For buyers, that’s “no-timetable” confidence and easy city access.

Green space, trails & sport

Ashgrove’s lifestyle edge is its greenery. Banks Street Reserve forms a bushland backdrop of ~83 acres/34 ha and has been progressively protected since 1939—a rare inner-city reserve with walking tracks, birdlife and creek corridors right on the doorstep. The Enoggera/Ithaca Creek Bikeways stitch Ashgrove to Red Hill, Newmarket, Windsor and Herston for safe riding, running and family walks. Community sport centres on Ashgrove Sports Ground, where a $4.125m clubhouse (opened 2023) upgraded facilities for rugby and cricket—great news for families.

Schools that sell houses

Education choices are a major driver here. Catchments and independent options include:

Marist College Ashgrove (boys, 7–12) on Frasers Rd.

Mt St Michael’s College (girls, 7–12) on Elimatta Dr.

Ashgrove State School (P–6) and Oakleigh State School (P–6) serve the area’s family streets.

Grammar belt advantage

From Ashgrove, families are within easy reach of Brisbane Boys’ Grammar School and Brisbane Girls Grammar School, both on Gregory Terrace, Spring Hill beside Roma Street Parkland—an easy school run with frequent city services. The high-frequency 385 and 61 Maroon CityGlider link Ashgrove to the CBD bus hubs (Roma Street / King George Square), while the Inner Northern Busway makes after-school activities and city connections simple. For older students, QUT Kelvin Grove (149 Victoria Park Rd) sits just ~2 km away with its own busway station—buses to Roma Street run every few minutes and the Ashgrove–QUT trip can be as quick as six minutes.

Brisbane Girls Grammar School (BGGS)

Brisbane Girls Grammar School (BGGS). Founded in 1875 and academically non-selective, BGGS is widely regarded as one of Queensland’s flagship girls’ schools. Its 2024 cohort achieved a median ATAR of 96.20 (one student at 99.95), a result that places the school at or near the top of most Queensland ATAR-based tables compiled by third parties. Nationally, BGGS is regularly cited among Australia’s leading independent day schools based on academic outcomes and university pathways.

Brisbane Grammar School (BGS)

Brisbane Grammar School (BGS). Established in 1868, BGS likewise operates on a non-selective intake and is consistently profiled as a top-tier boys’ school in Queensland. In 2024 it reported a median ATAR of 95.40, with five students achieving 99.95, again placing BGS near the top of statewide rankings published by independent compilers. The school’s outcomes and alumni network underpin its strong reputation nationally among Australia’s premier boys’ schools.

Notes for clients

There is no single official national ranking; media and tutoring organisations publish lists using different methods. The most reliable indicators are the schools’ own ATAR releases (above) plus recurring appearances near the top of QLD ranking summaries (e.g., Better Education, Excel Academics). Together, these show both BGGS and BGS are elite, high-performing choices in Queensland with nationwide name recognition.

Everyday convenience

Two full-line supermarkets keep weekly shops simple: Woolworths at Ashgrove Marketplace (Ashgrove Ave) and Coles at Ashgrove Shopping Village (Stewart Rd) sit minutes apart—surrounded by cafés, pharmacies and services. The Ashgrove Library on Amarina Ave adds story time, study nooks and community events.

Health within easy reach

Major hospitals are a short hop: Royal Brisbane & Women’s Hospital (Herston) and St Andrew’s War Memorial Hospital (Spring Hill)—a practical advantage for families, older residents and health workers alike.

Ashgrove’s price engine: tight supply, school-belt demand, and a city still rising

Ashgrove’s house values accelerated through 2024–2025, lifting from roughly $1.63m (mid-2024) to about $1.8–$1.9m by early–mid 2025. Fresh portal reads now peg the 12-month house median at ~$1.89m and units at ~$805k, with houses renting ~$800/wk (≈2.8% yield) and units ~$600/wk (≈4.0%)—textbook blue-chip settings where owner-occupiers dominate and yields trail capital growth.

Momentum in the numbers

Price level. REA’s suburb profile (Aug 2024–Jul 2025) shows houses $1.89m (up 9.6% YoY) and units $805k (up 14.8%). Your Investment Property (CoreLogic-sourced) shows a near-identical house median $1.844m, +10.42% YoY. Calibre’s Q1 wrap (drawing on REA/CoreLogic) recorded $1.80m for the 12 months to Mar 2025, +10.1% YoY—three lenses, one story: steady, upper-single-digit growth.

Sales velocity. Days on market range from ~24 days (to Mar 2025) to ~37 days (to Jul 2025) as activity ebbs with seasonality; CoreLogic-sourced YIP shows ~28 days for the year to May 2025. In short: listings turn over quickly for an inner-west family suburb.

Volumes & stock. REA counts ~140 house sales in the past year and only ~51 properties for sale last month—lean stock for a suburb of Ashgrove’s size. CoreLogic via YIP reports 181 house sales to May 2025.

Why the curve is “firmly upward”

Macro tailwinds. Brisbane remains one of the faster-growing capitals; PropTrack’s July 2025 index has Brisbane up ~9% YoY, with prices still pushing record territory nationally. August saw the RBA’s third rate cut of 2025 (cash rate to 3.60%), and consumer sentiment hit a multi-year high—improving borrowing capacity and buyer intent.

School-belt effect. Demand concentrates around top state primaries and the Gregory Terrace “Grammar belt” (BGS/BGGS within an easy CBD commute), pulling family buyers into Ashgrove’s catchment and adjacent busway corridors—supporting depth at the mid-to-upper price points.

Structural scarcity. Large parts of inner-west Brisbane sit under Traditional Building Character controls that retain pre-1947 houses and require sympathetic new work, constraining knock-down/ rebuild supply and protecting streetscapes that buyers prize. Scarcity = pricing power in blue-chip pockets.

Houses vs units: a widening two-speed lane

Houses: premium, family-oriented stock with character appeal; yields ~2.7–2.8% reflect owner-occupier dominance and low investor reliance. Time on market remains tight despite winter.

Units: faster YoY growth (≈15–19%) from a lower base and slightly stronger yields (~4%). For budget-constrained buyers chasing proximity to CBD/schools, units have become the entry ticket.

Risks to watch (and why they look contained)

Affordability ceiling. RBA easing boosts capacity, but Brisbane’s growth (~9% YoY) and record national prices could test budgets; still, Ashgrove’s buyer pool skews higher income/education, historically resilient to rate volatility.

Stock spikes. A surge in listings could cool momentum—but current for-sale counts remain lean for the suburb.

Policy/planning shifts. Any loosening of character controls might add supply over time, yet Council guidance continues to retain pre-1947 fabric; near-term dilution looks unlikely.

Bottom line for buyers & sellers

Ashgrove sits exactly where 2025’s demand is strongest: near-CBD, school-belt, scarcity-constrained. With medians hovering ~$1.85–$1.89m for houses and ~$805k for units, plus quick selling times, the suburb remains a price-resilient, owner-occupier market with investor-appropriate unit yields on the side. Expect competitive campaigns for renovated character homes, and steady absorption for quality townhouses/units close to bus corridors and schools.

Data & sources: suburb medians, yields, DOM and stock from realestate.com.au suburb profile (Aug 2024–Jul 2025); corroborating medians/DOM and growth from CoreLogic-sourced YIP and Calibre (REA/CoreLogic); market backdrop from PropTrack (Jul 2025) and RBA/consumer sentiment (Aug 2025); supply context from Brisbane City Council character-area guidance.

Disclaimer

This publication is provided for general marketing and information purposes only and does not constitute advice (including financial, legal, tax or investment advice), an offer, or a solicitation. All figures (including medians, price ranges, yields, sales volumes, and days-on-market) are indicative only, compiled from third-party sources believed to be reliable (e.g., ABS 2021 Census, major property portals and analytics providers) and are current as at August 2025 unless stated otherwise. Data may change without notice; past performance is not a reliable indicator of future results.

Distances, travel times and catchment/zone information are approximate and subject to change by the relevant authorities; school rankings and availability may vary from year to year. Planning controls, approvals and development details are likewise subject to authority requirements and revision. Images, renders, floor plans and maps are illustrative and not to scale; fixtures, finishes and specifications may differ at completion.

Prospective purchasers and tenants must rely on their own enquiries and obtain independent professional advice. No warranty or representation is given, and, to the maximum extent permitted by law, the publisher/agency/developer accepts no liability for any loss or damage arising from reliance on this document. All prices are in AUD and may be inclusive or exclusive of GST as applicable. Properties are offered subject to contract and availability; the right is reserved to amend or withdraw any offering at any time.

Comments