Olympics in a Tight Market: The Brisbane Equation

- Cyan Dai

- Jul 17, 2025

- 5 min read

Why Brisbane 2032 Is More Than an Event—And Less Than a Miracle

The decision to award Brisbane the 2032 Olympic and Paralympic Games has set in motion an unprecedented cycle of public investment and expectation. Yet as economists, it is prudent to ask: will the Games genuinely transform the city’s economy and housing market—or will they merely accelerate trends already in motion?

Bluecoast Properties has reviewed the data, the budget forecasts, and the historical experience of past host cities to answer this question with a cool head rather than a warm heart.

The Investment Case: A Story of Relative Scale

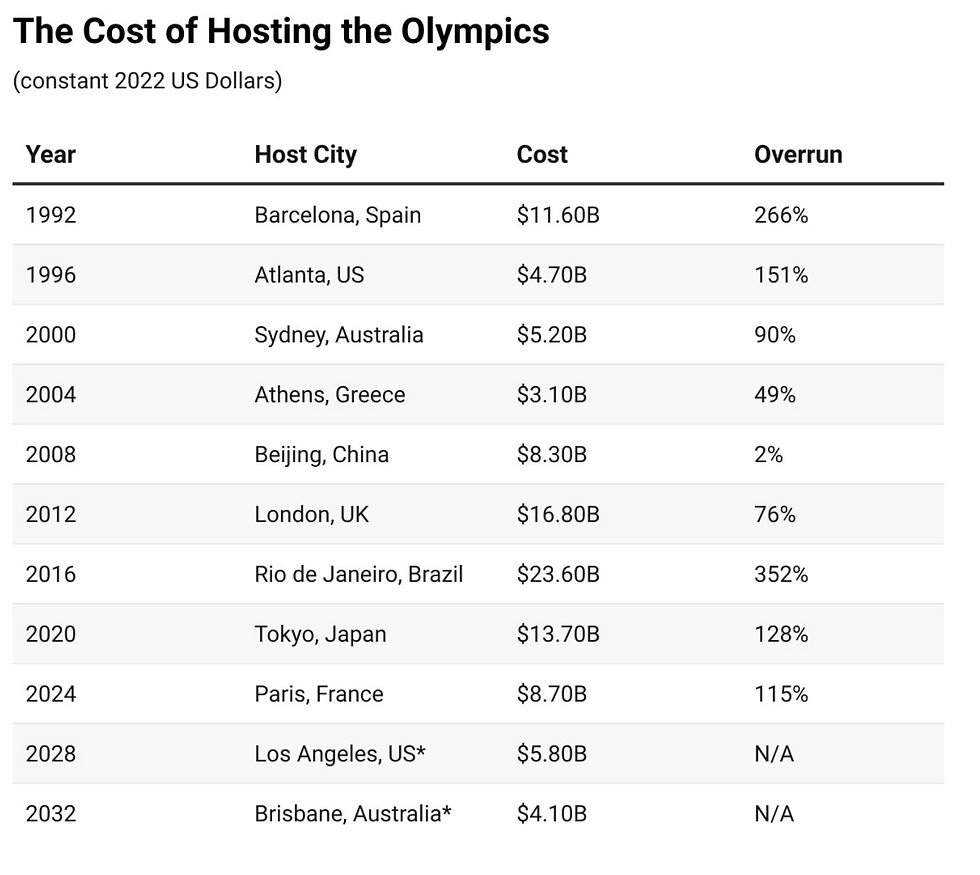

Most commentary has focused on the headline number—an updated projected budget approaching AUD $8.8 billion. However, from a macroeconomic perspective, the critical factor is not the dollar amount per se, but the relative scale of spending compared to Brisbane’s economic base.

By hosting the Games, Queensland will be committing public capital equivalent to around 2–3% of Gross State Product spread over 7 years. In isolation, this is not transformational. But when combined with:

Decades of pent-up infrastructure underinvestment,

A low population density relative to other global cities, and

A structural shortage of dwellings,

…the result is a set of economic multipliers that could exceed the sum of their parts.

Unlike Sydney in 2000, Brisbane enters the Olympic cycle without a prior wave of speculative housing supply. Recent ABS building approvals data confirm that approvals are falling, not rising. That fact alone creates a different foundation than any Australian host city before it.

Economic Constraints: The Cost of Scarcity

From an economist’s lens, it is equally important to acknowledge constraints:

Labour scarcity – Infrastructure booms divert labour from residential construction, suppressing supply elasticity.

Materials inflation – A large pipeline of publicly funded works raises input costs, even before private development is considered.

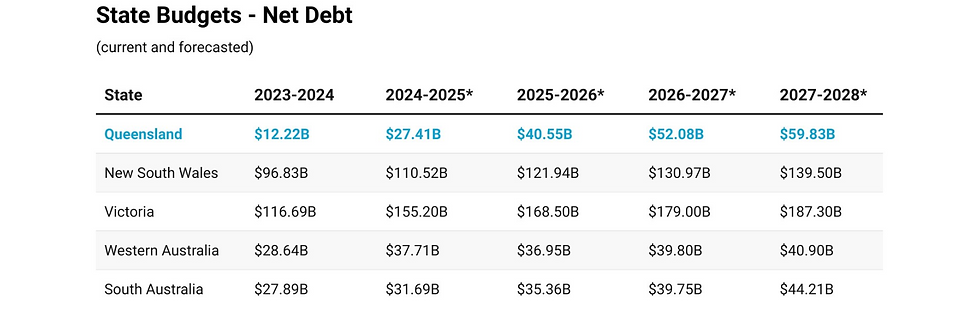

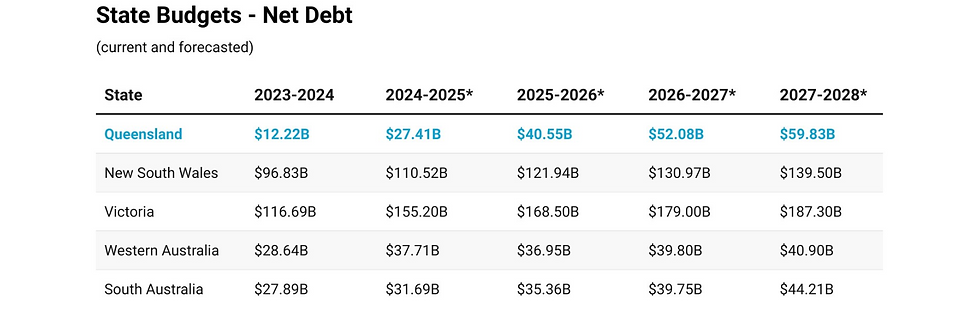

Debt sustainability – While Queensland’s net debt remains lower than NSW or Victoria, the uplift in liabilities is material and will test budget discipline in an era of rising borrowing costs.

These factors mean the Olympics should not be mistaken for an unambiguous boon. In a constrained environment, new infrastructure can act as both an economic stimulant and an inflationary force.

The Demand Shock: Global Attention Meets Local Undersupply

Economic literature is clear: mega-events create demand shocks that can outlast the event itself.

Host City & Demographic Perspective

It is worth revisiting a central idea that frequently escapes mainstream commentary: the scale of Brisbane itself as a host city.

Put simply, Brisbane will be the smallest metropolitan area to stage a Summer Olympics since Montreal in the 1970s.

Moreover, among modern host cities, it stands out not only for its limited population but also for having one of the lowest levels of urban density.

In summary, several conditions converge here:

A modest population base combined with sparse urban density;

A housing market already struggling with structural undersupply;

Constrained capacity to deliver substantial new housing in the near term; and

A gradual increase in international attention from what has historically been a relatively low profile.

Together, these factors create what can be described as a highly combustible mix for South East Queensland.

From a purely economic perspective, even a modest injection of capital and overseas buyer demand could exert an outsized impact on local property markets, given the limited scale of the region.

Historical Comparisons: Lessons from Other Host Cities

Atlanta, USA

When Atlanta secured the Games for 1996, it ranked only 11th in the United States by population—far behind heavyweight cities like New York, Los Angeles, and Chicago.

Between the announcement in 1990 and the years following the Games, housing prices advanced significantly. What makes this particularly notable is that the increase occurred despite a substantial expansion in housing supply during the same period.

By contrast, the circumstances Brisbane faces today—scarce developable land, elevated construction costs, declining building approvals, and persistent trade shortages—mean it is highly improbable that a comparable surge in housing development could unfold here in the lead-up to 2032.

Sydney, Australia

Sydney’s property market climbed roughly 44% from the early planning stages of the 2000 Olympics through to the Games themselves, then proceeded to record another impressive uplift of over 60% in the following four years.

Even in a higher-cost environment, Sydney outpaced Melbourne and Brisbane over the same timeframe in both nominal and percentage growth terms.

With seven years remaining until the opening ceremony, the probability of sustained upward pressure on Brisbane property values remains significant, based on these international precedents.

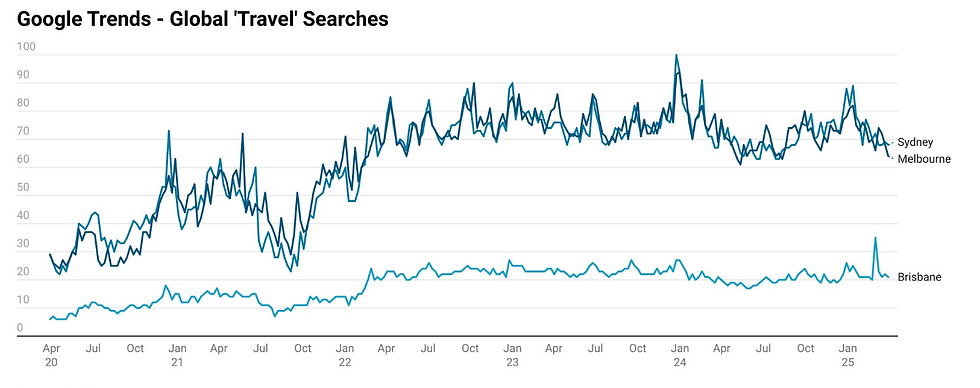

And if there is any doubt about Brisbane’s current level of global recognition, one need only look at comparative search data for Australia’s major cities—Brisbane still lags well behind in international mindshare.

To distil the argument, several conclusions emerge:

Queensland is financially positioned to deliver the Games without excessive fiscal strain;

Brisbane will be among the least populous and least dense metropolitan areas to host a modern Olympics;

The city’s compact size and persistent housing shortage mean that any incremental rise in international demand could translate disproportionately into price growth; and

The region has yet to experience widespread global exposure, suggesting there is still significant scope for perception—and investment—to evolve.

The next several years will bring transformative infrastructure and reposition Brisbane in the eyes of the world.

New infrastructure attracts a workforce. That workforce must live somewhere.

In a market already grappling with limited supply, additional demand could prove a powerful catalyst.

Are you prepared for what’s ahead?

“To host the Olympic and Paralympic Games is a once-in-a-generation opportunity, and we’ll make it count for Queensland with a lasting legacy.” David Crisafulli, Premier of Queensland

The Bluecoast Perspective: Neither Boom nor Bust

Our thesis is neither blindly optimistic nor unduly sceptical. The Brisbane Olympics are unlikely to create a property “bubble” on their own. But they are likely to act as an accelerant for:

Continued densification in key urban corridors;

Capital inflows targeting limited premium stock;

A re-rating of Brisbane’s perceived investability relative to Sydney and Melbourne;

Infrastructure that increases the desirability of peripheral and coastal submarkets.

In other words: The Olympics will not manufacture demand ex nihilo—but they will amplify it in ways that could be persistent, particularly in a constrained supply context.

A Rational Framework for Investors

Brisbane 2032 will neither rescue the market from cyclical forces nor doom it to unsustainable speculation. Instead, the Games will act as a structural tailwind—one that, when combined with demographic growth, chronic undersupply, and relative affordability, can underpin a new chapter of urban evolution.

For investors and homeowners alike, the essential question is not whether the Olympics are good or bad, but whether you have a plan to navigate the opportunity and constraint in tandem.

At Bluecoast Properties, we see the next decade as a period of disciplined optimism—grounded in data, not hype.

Bluecoast Properties

Economic insight. Local expertise.

Comments